What Is a Pip?

Pips , another way to say “percentage in point” or “price interest point” is a normalised unit of estimation utilised in monetary business sectors, particularly in the forex (unfamiliar trade) market. It addresses the littlest cost development that can happen in a money pair’s conversion scale. For most cash coordinates, a pip is commonly comparable to 0.0001, or one 100th 100th of a percent. Notwithstanding, at times, a pip can be comparable to 0.01, particularly for money matches including the Japanese yen. Pips are fundamental for estimating cost changes, deciding possible benefits or misfortunes, and surveying market unpredictability in forex trading. In this guide we will discuss Pips in Forex Trading. I suggest Crypto Signals Org because this brand is expert in forex work. Their Free and Paid signals are very help for community/

Understanding Pips in Trading

Understanding pips is vital in the realm of trading, especially in the forex market. A pip, which means “rate in point” or “cost revenue point,” addresses the littlest steady cost development that a money pair can insight. In most money coordinates, a pip is normally identical to 0.0001, or one 100th 100th of a percent. For instance, if the EUR/USD money pair moves from 1.1000 to 1.1001, it has moved one pip.

Pips assume a focal part in estimating cost changes, working out likely gains or misfortunes, and overseeing risk in trading. Dealers frequently use pips to decide passage and leave focuses, set stop-misfortune and take-benefit levels, and survey the unpredictability of the market. The worth of a pip fluctuates in light of the size of the exchange and the cash pair being exchanged. Understanding how to ascertain and decipher pips is fundamental for powerful gambling the executives and pursuing informed trading choices in the forex and other monetary business sectors.

Read Also : Business

How to Calculate Pip Value in Crypto

Working out pip esteem in the digital currency market is somewhat not quite the same as conventional forex trading because of the shortfall of normalised parcel sizes. This is the way you can compute pip an incentive for cryptographic money trading:

-

Decide the Pip Size:

First, distinguish the littlest cost development for the cryptographic money pair you’re trading. This can fluctuate in light of the quantity of decimal spots in the cost statement. For instance, in the event that the cost moves from 0.0120 to 0.0121, the pip size is 0.0001.

-

Work out the Position Size:

To compute pip esteem, you really want to realise your position size as far as the cryptographic money you’re trading. This is normally estimated concerning the base cash.

-

Utilise the Recipe:

The equation to compute pip esteem is:

Pip Worth = (Position Size/Conversion scale) * Pip Size

Here, “Position Size” is how much digital money no doubt about it, “Conversion standard” is the ongoing cost of the cryptographic money pair.

Model Computation:

Suppose you’re trading 2,000 units of Bitcoin (BTC) against US Dollar (USD), and the pip size is 0.0001 BTC. On the off chance that the ongoing BTC/USD swapping scale is $40,000, the computation would be:

Pip Worth = (2,000 BTC/$40,000) * 0.0001 BTC = $0.005

This truly intends that for each pip development in the BTC/USD pair, your position would acquire or lose $0.005.

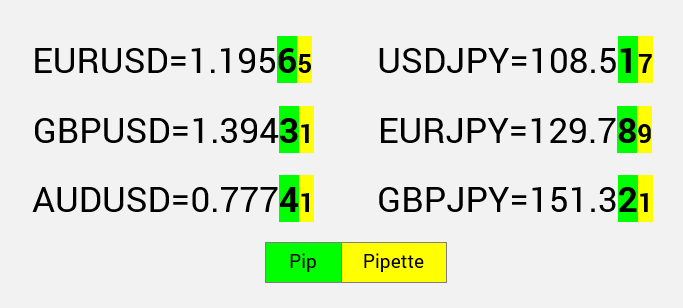

What Is the Difference Between a Pip and a Pipettes?

The expressions “pip” and “pipettes” are both used with regards to trading to mean cost developments, particularly in the forex and digital currency markets. Be that as it may, they allude to somewhat various degrees of accuracy:

Pip:

A pip, which means “percentage in point” or “price interest point” addresses the littlest cost development that a cash pair can insight. In most cash coordinates, a pip is commonly identical to 0.0001, or one 100th 100th of a percent. For instance, if the EUR/USD money pair moves from 1.1000 to 1.1001, it has moved one pip.

Pipettes:

A pipette is a fragmentary part of a pip. It’s not unexpectedly utilised when the value developments are tiny, and a more elevated level of accuracy is required. A pipette is equivalent to one-10th of a pip, or 0.00001 in most money matches. Thus, if the EUR/USD pair moves from 1.10000 to 1.10001, it has moved one pipette.

How we Use Pip in Trading

In trading, a pip, which means “rate in point” or “cost revenue point,” is utilised to gauge cost developments and compute expected benefits or misfortunes. Dealers use pips to:

- Measure Value Changes: Pips evaluate the littlest cost developments in money matches or other monetary instruments. They assist dealers with understanding how much the swapping scale has moved.

- Work out Benefit and Misfortune: Merchants ascertain their likely gains or misfortunes by duplicating the pip esteem by the quantity of pips the cost has moved. This assists them with evaluating the monetary effect of their exchanges.

- Set Section and Leave Focuses: Merchants use pips to decide passage and leave levels for their exchanges. They set stop-misfortune and take-benefit orders in light of the distance in pips from the section cost.

- Oversee Chance: Pips assist brokers with overseeing risk by deciding the size of their positions comparative with their record balance. A specific number of pips might address a particular level of their capital in danger.

- Survey Market Instability: Pips give experiences into market unpredictability. Bigger pip developments might show more unstable circumstances, influencing trading procedures.

- Decide Position Size: Dealers use pips to work out the proper position size for their exchanges, taking into account their gamble resistance and wanted likely benefit.

- Break down Authentic Execution: Pips assist brokers with evaluating the exhibition of their trading methodologies over the long haul by estimating the number of pips that were acquired or lost.

Why Are Forex Pips Important

Forex pips are pivotal in trading since they act as a normalised measure for cost developments, empowering merchants to evaluate and examine market elements precisely. By addressing the littlest gradual change in money matches, pips offer a steady unit for working out benefits, misfortunes, hazards, and exchange sizes. Merchants use pips to set section and leave focuses, oversee risk through appropriate position estimating, and decide likely rewards. Moreover, pips give a typical language to correspondence among brokers and assist in evaluating with showcasing unpredictability. Generally speaking, the meaning of forex pips lies in their job as a central device for exact navigation, risk the executives, and assessment of trading methodologies. In this guide we discuss What Are Crypto Pips in Forex Trading and What Is Their Value. If you want to know more about it.

Conclusion

All in all, understanding and successfully using pips in trading are major for exact estimation, risk the executives, and key direction. Pips act as the basic unit for measuring cost developments, working out expected gains and misfortunes, and deciding ideal exchange sizes. Whether in the forex or cryptographic money markets, pips give dealers a normalised method for evaluating market elements, set passage and leave focuses, and oversee risk really. By appreciating the meaning of pips and their job in assessing trading execution, brokers can pursue educated decisions and explore the intricacies regarding monetary business sectors with more noteworthy accuracy.